Part III of III

laws. A simple search of the Internet

under “Estate Tax” or “Gift Tax” will provide many good

resources, including the IRS, which should give you the

insight you need.

For many years the “Applicable Credit”

shielded $600,000 per person. You had a credit and your

spouse also had a credit. The problem came when you left

your estate to your spouse by will, or died intestate.

Your funds were then added to your spouse’s and in

essence, upon the surviving spouse’s death, only

$600,000 remained exempt. A simple solution was

developed in the form of an “inter vivos trust”

(revocable living trust) shielding $1,200,000. in the

past.

http://www.investorwords.com/2577/inter_vivos_trust.html

You have heard of this under a lot of

fancy names including “Loving Trust”. This form of

“Revocable Living Trust” is simple and may be

established at a very reasonable cost. A “Pour-Over

Will” is also executed at the same time, placing any

property you may have failed to include within the trust

into the trust upon death. The spouse never owns the

contents of the Trust but does have the use of the trust

assets, subject to minor limitations. This preserves the

tax exemption for your children and the net result was

an exemption covering an estate (husband and wife

combined) of $1,200,000. Now the figure would be

$3,000,000. for year 2005. This way, you have no

property upon death. No clothes; no cars; no airplanes;

no boats; no house; no bank account; no jewelry; no

property, real or personal. All of these are owned by

your trust.

But what if I want to spend $50.00 for

dinner? When you write the check from your trust-held

bank account to pay the credit card bill you simply

“revoke” $50.00 of the Trust Assets. The same would

apply to any of your trust assets you chose to revoke

and dispose of. Again, you would grant your surviving

spouse the rights to use part of your trusts assets

after your death for living expenses, health needs etc.

You may make your spouse the “Successor Trustee” of your

trust upon your death or if your estate is extremely

large, it would be safer from a tax compliance

standpoint to name a bank trust department to assure no

mistakes are made in the handling of the Trust after

your death. Fees are negotiable and you may expect extra

charges to be made for assets such as real estate, which

requires additional handling. I have seen fees as low as

“45 basis points” to as high as “175 basis points”. (A

basis point is 1/100 of a percent.) The experienced

banks, handling thousands of these trusts, with usually

over 200 trusts per bank officer, are negotiable. Your

financial advisors should direct you to a choice of

banks.

One or two cautions: If your finances are

in mutual funds, you are already paying one fee for

management and the “bank fee” should be only a simple

handling charge. But if your assets require management

and investment services, then expect higher fees.

Second, the bank’s officer is not the person you want to

depend on, necessarily, as they may or may not have time

and/or the ability you want or expect. Have the bank

officer answer to someone in whom you have confidence.

i.e. spouse, relative, or trusted friend. Include

provisions for moving the trust to another fiduciary in

the event the bank does not satisfy your spouse.

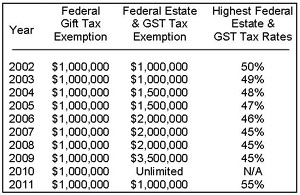

At the right of this page is a table of

the effective exemption from estate taxes and maximum

you may give. “GST” is “Generation Skipping Tax” a far

more complex issue for which you should use a qualified

attorney, CPA or preferably a tax attorney with a

masters degree in tax law, in addition to their J.D. or

LLB degree. An attorney (with a masters in tax) can

|

|

have a

fee structure which will seem very high, but you do have

the option to paying many times their fee in taxes if

you prefer. You “generation skip” when you gift or leave

estates to your grandchildren or in other parallel

persons.

A

separate additional annual exclusion applies to each

person to whom you make a gift. For the year 2005, the

annual exclusion is $11,000. Therefore, you generally

can give up to $11,000 each to any number of persons in

2005, and none of the gifts will be taxable or apply

against your lifetime “federal gift-tax exemption”. In

2005, both you and your spouse (if you are married) can

separately give up to $11,000 (for a total of $22,000)

to the same person, without making the gift taxable. If

one of you gives more than $11,000 to a person in any

one of these years, refer to gift splitting in

IRS Publication 950,

“Introduction to Estate and Gift Taxes”. Gifts to

individuals are not deductible but would reduce your

gross taxable estate.

Technically, at the current $11,000 gift figure, you

would arguably have to file a “Gift Tax Return” which is

a capricious decision enforced by some IRS agents. An

easy way to avoid this problem is NOT to gift the full

$11,000. but simply limit your gift to $10,990. Always

remember that the IRS rounds up and the Social Security

Administration does the opposite and rounds down. The

problem of capricious agents also has surfaced when you

give to family or charity from your inter vivos trust.

The

simple way to avoid this public servant (with seemingly

nothing better to do) is to set up a bank account in

your sole personal name and limit the balance amount to

$100. Then when you give money to any charity, person,

or entity you simply transfer the funds from your inter

vivos trust checking account, to your personal checking

account, and make the gift from your personal account. A

problem can occur when an arbitrary and capricious agent

claims that it was the inter vivos trust which gave and

not you personally. Incidentally, no tax return is

required of the inter vivos trust, as all income and

deductions are on your personal return.

In the next issues of

CONTACT! Magazine information will be provided giving

ideas on how to pass funds without tax, with reduced

tax, with some benefit to your loved ones, and to

charities while still receiving tangible and intangible

advantages to you. Future donors who give Aeronautics

Education Enterprises will be acknowledged with their

permission in this column of your publication.

CONTACT! Magazine and

AEE offer this reference material only as a suggestion

that ideas presented should be discussed with your

attorney, CPA, accountant and/or other financial

advisors.

Percy (Pat) Lorie III

|